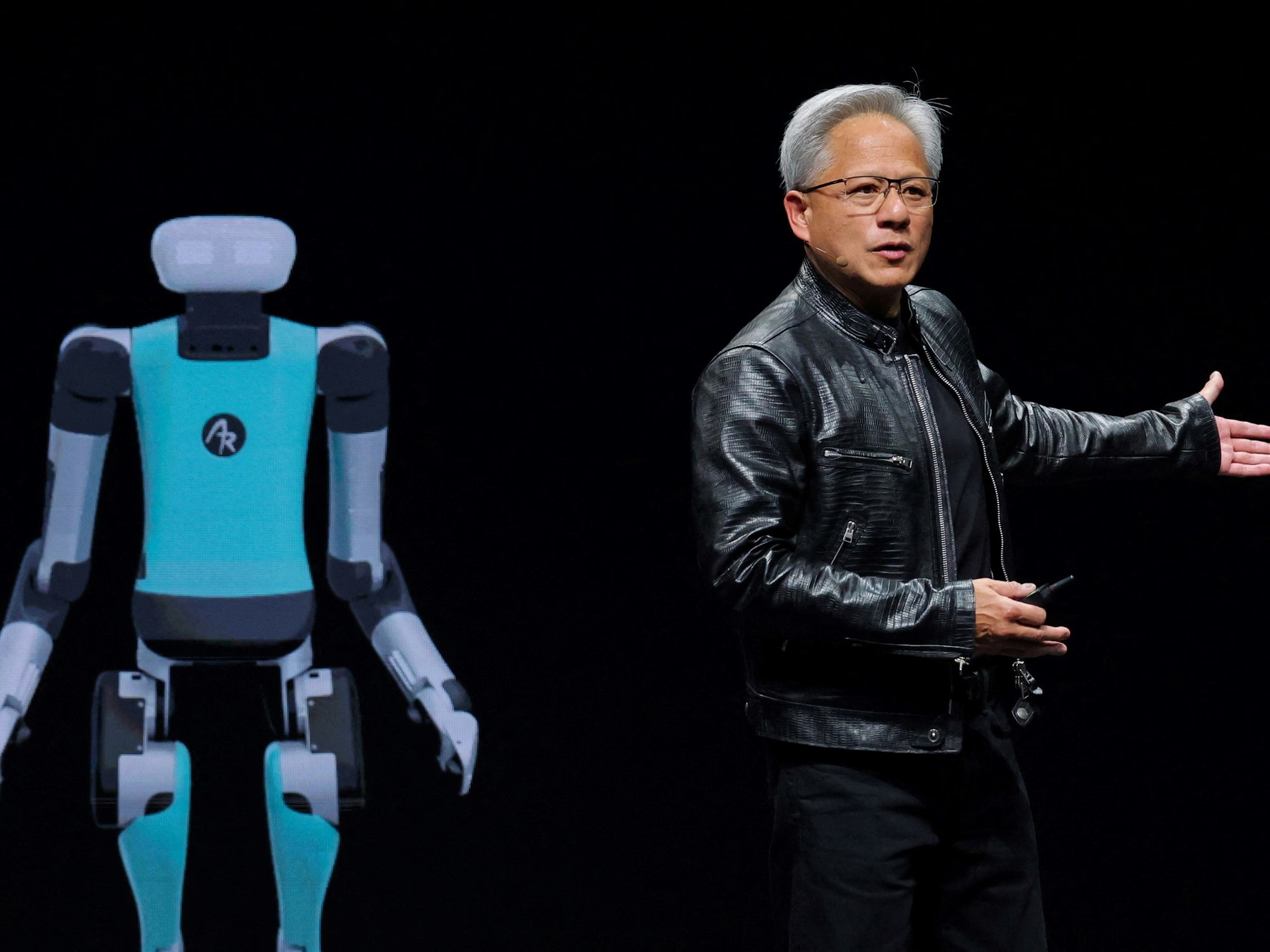

Nvidia Becomes World's First $5 Trillion Company Amid AI Boom

US chipmaker Nvidia reached a $5 trillion market valuation on Wednesday, becoming the first company globally to hit the milestone, driven by soaring AI demand.

October 29, 2025 - 01:45 PM ET • 3 min read

Nvidia, the Santa Clara, California-based chip manufacturer, became the first publicly listed company in the world to achieve a market valuation of $5 trillion on Wednesday, October 29.

The milestone was reached as shares in the company soared by as much as 5.6% in morning trading, pushing the stock price past $212. The rapid ascent underscores the intense investor confidence surrounding the artificial intelligence (AI) revolution, which relies heavily on Nvidia's specialized graphics processing units (GPUs).

Nvidia's climb to the $5 trillion mark highlights the speed at which the AI spending spree has reshaped the technology sector. The company had only reached the $4 trillion valuation threshold three months prior, in July, and first crossed the $1 trillion valuation mark in June 2023.

The chipmaker has successfully transitioned from a manufacturer focused primarily on graphics chips for video gaming into the dominant supplier for AI infrastructure. Analysts noted that the company's chips are considered essential for fueling the current technological shift. Wedbush analyst Dan Ives stated that "Nvidia's chips remain the new oil or gold in this world for the tech ecosystem as there is only one chip in the world fueling this AI revolution ... and it's Nvidia."

The company's valuation now exceeds the gross domestic product (GDP) of most countries globally.

The surge in Nvidia's stock price is directly linked to the overwhelming demand for its GPUs, which are critical components for training and running large language models and other complex AI applications. The company has secured key deals and partnerships with leading AI developers, including OpenAI and Palantir, as well as cloud computing giants like Oracle.

Investor optimism was further boosted by recent corporate activities, including strong sales outlooks, particularly in China, and the announcement of a deal to purchase $1 billion in Nokia shares.

Nvidia's achievement surpasses previous corporate valuation milestones set by other technology leaders. Apple, which leveraged the success of the iPhone to become the first publicly traded company valued at $1 trillion, $2 trillion, and $3 trillion, currently holds a market capitalization of approximately $4 trillion, sitting behind Nvidia. Microsoft, Alphabet (Google's parent company), Amazon, and Meta follow in valuation rankings.

Despite the euphoria driving the stock market, concerns persist among financial regulators regarding the sustainability of the AI boom.

Officials from the Bank of England raised alarms earlier this month about the growing risk that technology stock prices, inflated by the AI surge, could potentially burst. The International Monetary Fund (IMF) has issued similar warnings, suggesting that the rapid, concentrated growth in the technology sector could lead to a market bubble.

The current AI boom is widely viewed as the most significant technological shift since the introduction of the first iPhone 18 years ago, but the rapid acceleration of valuations has prompted caution among global financial institutions.